GoodCorporation's ESG and sustainability services

GoodCorporation works with clients to help them analyse and understand their material ESG issues. Our services enable organisations to identify what needs to be done to demonstrate a responsible approach to the management of environment, social and governance issues and how to comply with all reporting requirements.

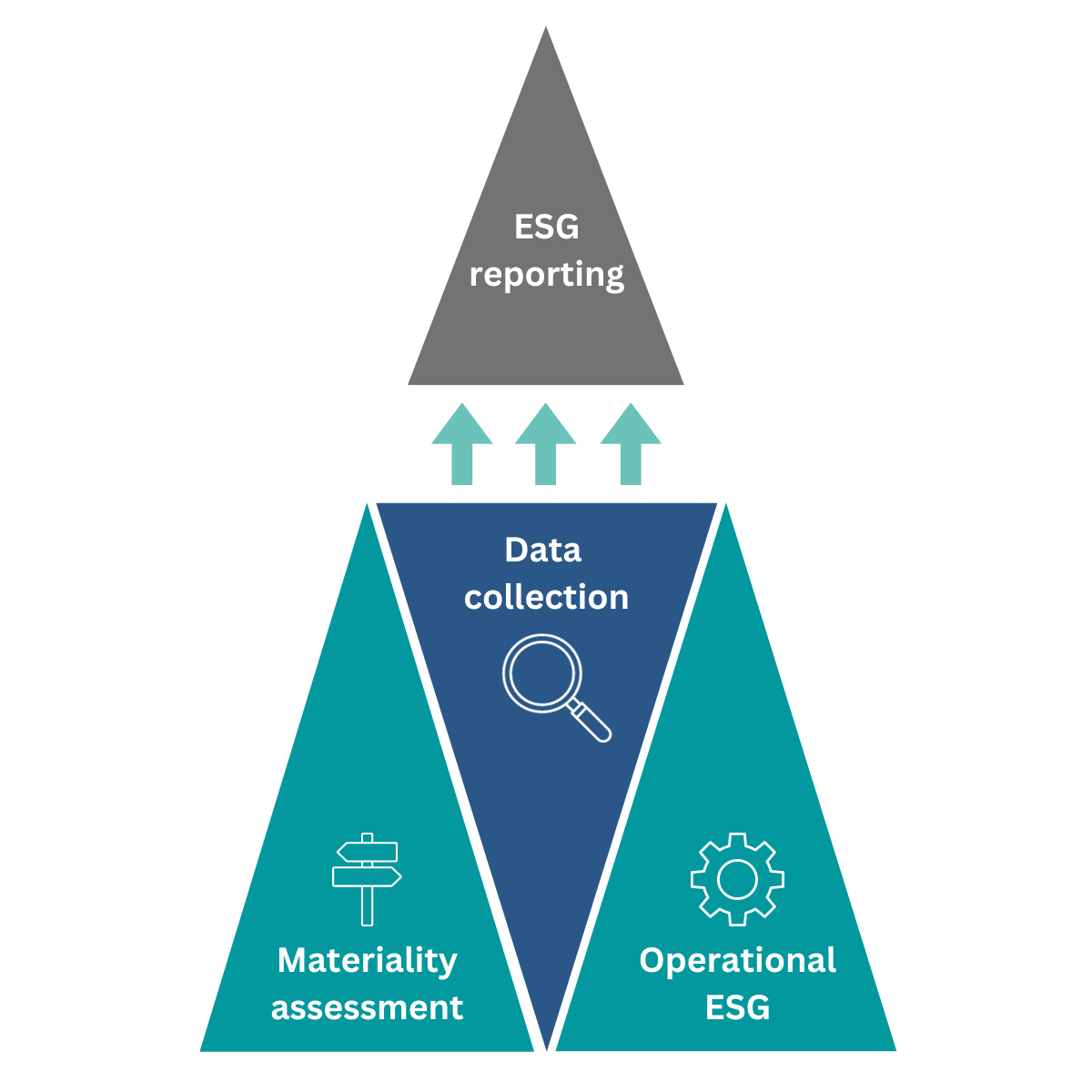

Our ESG services focus on three key areas:

A materiality assessment is the critical first step in the development of any ESG strategy, enabling an organisation to identify the key ESG issues that will have an impact on both business performance AND key stakeholders.

A suite of services to enable an organisation to understand applicable legal and other reporting requirements, developing the framework, metrics, policies, procedures and necessary data to improve ESG performance and meet reporting obligations.

A meaningful ESG strategy needs to be embedded into the systems and processes of an organisation. GoodCorporation deploys over 20 years' experience in building and embedding responsible management systems to help organisations operationalise their ESG strategy.

ESG materiality assessments

ESG risks will vary from organisation to organisation so it is critical to identify the specific ESG issues salient to your business that have an impact on both performance and stakeholders.

GoodCorporation's Materiality Assessment will help identify all critical ESG risks and facilitate the development of a strategy to mitigate and manage the areas identified.

Our Materiality Assessment enables an organisation to:

- Identify key stakeholders to ensure all areas of the business and its operations are covered

- Identify and prioritise key ESG issues specific to your organisation

-

- Analysis of the nature of the business, location of operations, complexity of the supply chain: involve all key functions

- Environmental risks including, GHG emissions, biodiversity impact, land-use and water-use.

- Social issues e.g. human rights, worker welfare, DEI, community engagement, privacy and data protection

- Governance issues e.g. corruption, AML, transparency, policies and procedures

- Meet with internal stakeholders to build engagement

- Identify and agree key measurement metrics and KPIs

- Develop an ESG strategy and roadmap

ESG compliance and data gathering

A combination of legislative requirements and investor pressure is placing an obligation on organisations to gather data and information to demonstrate their responsible management of a range of environmental, social and governance issues.

GoodCorporation's ESG Compliance Support helps an organisation to:

- Identify all applicable legal and regulatory reporting requirements e.g IFRS, CSRD, CS3D, SFDR, TCFD, SEC, EU Taxonomy etc.

- Conduct a review and gap analysis of existing and relevant governance policies and procedures

- Develop a prioritized roadmap for improvement

- Set meaningful, pragmatic ESG targets

- Ensure data collection and evidence gathering mechanisms are in place: -

- Identify which material ESG issues are already being measured and managed

- Agree additional measurement metrics

- Verification of data and evidence

- Demonstrate that management systems align with key ESG goals

Operational ESG

Embedding ESG meaningfully into business activities and decision-making requires a viable ESG implementation plan. GoodCorporation works with clients to help design the systems and processes needed to embed ESG management throughout an organisation.

GoodCorporation's operational ESG involves:

- Developing of a bespoke ESG framework setting out how ESG goals and objectives will be met

- The framework should cover all material ESG issues identified

- Identifying the management systems needed to embed best practice across all areas of operation

- Demonstrating board and senior management commitment

- Establishing accountability and reporting systems

- Developing policies and systems that put the management of ESG risks and issues into practice

- Devising training and communications programmes to bring all relevant stakeholders on board

- Monitoring and reviewing progress to facilitate reporting and ensure continuous improvement.

Building an effective ESG strategy

GoodCorporation deploys an established methodology to help companies build an effective ESG strategy. We work closely with our clients to create a tailor-made ESG framework for assessment that leads to the development of a clear roadmap for material and measurable improvement. This involves:

- Determining material ESG factors in the context of evolving best practice in order to establish the right KPIs

- Analysing investor requirements, including ratings agencies, and conducting a peer analysis

- Conducting a gap analysis to identify what is currently measured, what needs to be put in place and prioritising 'quick wins'

- Creating a tailored ESG framework that contains all identified material ESG factors

- Building a strategic roadmap for implementing a meaningful ESG programme with an agreed governance structure, implementation plan and suggested reporting framework

GoodCorporation supports companies to integrate ESG into their business and develop a communications strategy for investors, employees and other key stakeholders.

GoodCorporation Environment Framework

The GoodCorporation Environment Framework provides set of responsible practices and procedures to help improve the robustness of any organisation’s environmental performance management. There are 43 framework points across 9 topics, including the governance of environmental topics, identifying and evaluating environmental risks and impacts of business activities, developing an effective environmental strategy and ensuring compliance to applicable environmental regulations.

It can be used to design or evaluate how environmental topics are managed as a whole or how specific issues are treated - such as greenhouse gas emissions, biodiversity impact, water use and land use for example. Use of the framework can also help organisations develop their sustainability strategies and embed environmental best practices into their business strategy.

Applicable to all relevant environmental issues, the framework can be used to help organisations align with global environmental standards and legislation by supporting the development of effective environmental management practices.

For organisations looking to develop an environmental roadmap, the framework can be used as a tool to perform a gap analysis against their current environmental management practices, enabling strengths and areas for improvement to be identified. As a high-level environment governance referential, it offers non-technical guidance to support organisations in managing their environmental responsibilities with regards to setting targets, improving environmental performance and meeting reporting requirements.

Why ESG matters

With the seemingly exponential rise in capital allocation to ESG funds, ESG is clearly here to stay. Our podcast explores the role of investors in driving the agenda and the steps businesses need to take to demonstrate ESG credentials.

We also examine the virtuous circle that an effective ESG strategy can help deliver, and explore how effectively managing ESG risks is integral to long-term sustainability.

GoodCorporation provides a range of services to help businesses develop create an effective framework for ESG.

GoodCorporation human rights and environmental due diligence framework

The GoodCorporation Framework on Human Rights and Environmental Due Diligence offers a comprehensive set of responsible business principles to help organisations strengthen the management of their human rights and environmental impacts across their chain of activities.

Use of the framework will help companies identify, prevent, mitigate and remediate their human rights and environmental impacts in order to comply with the EU Corporate Sustainability Due Diligence Directive (CS3D). In line with the directive, the framework defines 'due diligence' to mean the whole system of managing these impacts throughout the organisation’s’chain of activities’, extending to their own operations, those of their subsidiaries and business partners, all upstream activities and selected downstream activities.

This due diligence will entail not just the act of identifying these adverse impacts but also managing and remediating the harms found and establishing mechanisms to identify and alert the organisation to any future impacts.

Drawing directly on the measures set out in the CS3D, and incorporating best practice and international guidelines, the framework can be used to help ensure legal compliance, minimising potential liability and the prospect of fines, civil action and compensation. It can help organisations identify any gaps in their due diligence processes and develop robust due diligence systems to meet these new requirements.

The framework covers a range of key topics including top-level commitment, due diligence policy and processes, combating climate change, stakeholder engagement and grievance mechanisms, ensuring a comprehensive approach to sustainable business practices.

The evolution of ESG reporting

With a swathe of regulation coming into force, requiring businesses to demonstrate how environmental, social and governance (ESG) issues are managed, companies are under increasing pressure to report on a wide range of areas, but without an agreed framework for doing so.

So how are businesses reporting on ESG and why does this matter?

Our blog on ESG reporting explores the latest emerging trends for tackling these issues. It gives details of our ESG benchmark of best practice which we use to help companies assess how ESG targets are set, measured and reported on.

It explores the key areas that need to be measured and managed and how to go about this.

"European investment advisers who have traditionally focused on the environmental side are increasingly also prioritising social issues"

2022 Future Focus Survey – J.P Morgan Asset Management; October 2022.

Explore our frameworks

Browse our frameworks and request your copy