Combating corruption: are businesses doing enough?

Papers and reports | read time: 2 min

Published: 15 January 2015

Three years after the UK Bribery Act came into force, businesses are still struggling to implement the procedures necessary to prevent corruption, with over a third of almost 3,000 anti-corruption controls assessed by GoodCorporation graded inadequate.

The GoodCorporation paper Combating corruption: are businesses doing enough? reveals that a number of the anti-bribery procedures recommended by the Ministry of Justice are not being successfully implemented.

Sixty three per cent of the anti-corruption due diligence procedures assessed by GoodCorporation were found to be inadequate. Businesses are more at risk from corruption by third parties than in any other area of their business. Such a high level of inadequate procedures in the control of third parties will make businesses extremely vulnerable if facing prosecution for bribery.

The penalty for failing to implement adequate procedures to prevent corruption is high. Multi-million dollar fines, long term loss of share value, loss of business and reputational damage, the imposition of an external monitor are all costly to business.

Gap emerging between those succeeding in implementing controls and those that are not

Somewhat worryingly for business, the paper revealed a clear gap between those companies that are succeeding in putting adequate procedures in place and those that are not. GoodCorporation has divided the companies assessed into four quartiles, according to average grades. The disparity between the top and bottom quartiles is striking, with good companies outperforming weaker companies significantly. In the area of anti-corruption due-diligence this is particularly marked with 90 per cent of companies in the bottom quartile having inadequate procedures, versus just 19 per cent in the top quartile.

Combating Corruption: are businesses doing enough? is based on the results of anti-bribery and corruption assessments carried out by GoodCorporation for leading organisations in a broad cross-section of industries including oil and gas, telecoms, defence, manufacturing and pharmaceuticals. Assessment were carried out using GoodCorporation’s anti-bribery and corruption framework which comprises a list of 71 management practices that companies should follow in order to reduce the risk of corruption within their organisation. Composed with reference to recommendations from the OECD and Transparency International, GoodCorporation’s framework is based on the six principles outlined in the Ministry of Justice Guidance on the Bribery Act and is aligned with the US Foreign Corrupt Practices Act.

Further key findings from the white paper include:

• Companies in the top quartile are outperforming those in the bottom considerably with the biggest gap in the area of anti-corruption communication and training. Eighty two per cent of the controls were inadequate in the bottom quartile versus only 8 per cent inadequate in the top.

• All companies in the top quartile could demonstrate a strong top-level commitment to implementing ABC controls with a clear ABC policy that is widely and publicly communicated and a zero-tolerance statement from the board.

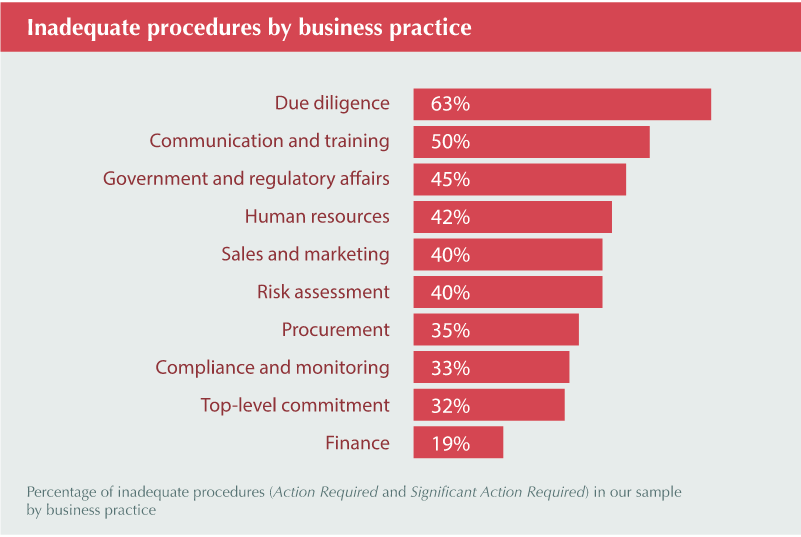

• Anti-corruption due diligence is the hardest area to get right (63 per cent inadequate) followed by communication and training (50% inadequate) government and regulatory affairs (45 per cent inadequate) and human resources (42 per cent inadequate).

• Functions used to regulation and policy compliance such as Finance and Procurement faired best with a low number of inadequate controls (19% and 35% respectively). However government and regulatory affairs departments are struggling to come to terms with implementing effective controls (45% inadequate) demonstrating that dealing with governments is still a very grey area that needs focus.

• Training of sales intermediaries is a particularly week area with 63 per cent of the procedures checked found to be inadequate. Given that this is an area particularly prone to malpractice, this should be a cause for concern and an area for renewed focus.

work with us